Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

Economic Contraction in Japan Fueled by Declines in Consumer Spending and Exports

TOPICSTags: GDP, Japan, Nikkei 225

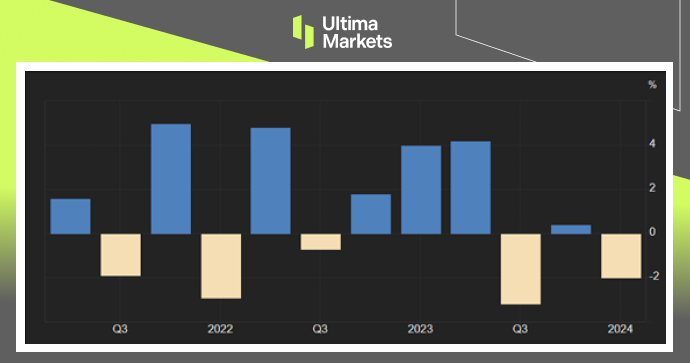

In the first quarter of 2024, a preliminary report indicated Japan’s economy contracted by 0.5% quarter-on-quarter, which was slightly more than the 0.4% decrease anticipated by analysts. This follows a revised report of no growth in the previous quarter.

The decline in private consumption, which is over half of the country’s economic activity, was sharper than expected. Consumption dropped 0.7%, extending its downward trend to a fourth consecutive quarter, and exceeded the projected 0.2% decline. This quarter’s reduction in spending is the most significant in the past three and is attributed to the high cost of living, sluggish wage growth, and the impact of an earthquake on the Noto peninsula earlier in the year.

Capital expenditure also fell by 0.8%, defying expectations of a 0.7% decrease, and was affected by a steep cut in automobile production tied to a scandal at Daihatsu Motor, a Toyota affiliate. The balance of exports and imports also hindered GDP growth, with exports falling 5.0%—a greater decline than the drop in imports at 3.4%—though this was in line with projections. Conversely, government spending provided a slight boost, increasing by 0.2% after previously falling by the same margin.

Consequently, Japan’s economy contracted by 2.0%YoY in the first quarter of 2024, a sharper decline than the 1.5% decrease that market analysts had expected.

(Annualized GDP Growth Rate%,Cabinet Office of Japan)

Following the sluggish economic report, Japan’s stock market indices declined on Friday, erasing the previous day’s gains. The Nikkei 225 Index dropped 0.9% to below 38,600, while the broader Topix Index fell 0.2% to 2,732. Technology shares were among the biggest decliners, leading the overall market retreat.

(Nikkei 225 Index Monthly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Neden Ultima Markets ile Metaller ve Emtia Ticareti Yapmalısınız?

Ultima Markets, dünya çapında yaygın emtialar için en rekabetçi maliyet ve değişim ortamını sağlar.

Ticarete BaşlaHareket halindeyken piyasayı izleme imkanı

Piyasalar arz ve talepteki değişimlere duyarlıdır

Sadece fiyat spekülasyonu ile ilgilenen yatırımcılar için çekici

Derin ve çeşitli likidite ile gizli ücretler yok

Dealing desk yok ve yeniden fiyatlandırma yok

Equinix NY4 sunucusu üzerinden hızlı yürütme