Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

U.S. Foreign & Trade Policy in Focus

TOPICSTags: Gold, Russian-Ukraine War, Trump Tariffs, US dollar

U.S. Foreign & Trade Policy in Focus: Market Impact & Key Developments

This week, market attention remains on U.S. foreign and domestic policy, particularly the Russia-Ukraine peace talks and international trade relations. On Thursday, President Trump’s public address and meetings propelled the U.S. dollar higher after three consecutive weeks of losses.

Trade Policy Escalates to Global Concerns

On Thursday, Trump reaffirmed that tariffs on Mexican and Canadian imports will take effect on March 4th as originally planned. With just five days remaining until implementation, concerns over global trade tensions have reignited.

Earlier, Trump also announced plans to impose tariffs on the European Union (EU) and signed a memorandum introducing the “Fair and Reciprocal Plan.” This initiative aims to align U.S. tariffs with those imposed by other nations on American goods. The policy specifically targets key U.S. trade partners, including the EU, Japan, and India, seeking to address perceived trade imbalances.

Meanwhile, the UK appears to have “avoided” the tariff threat. Trump suggested that the UK might be exempt from these tariffs, praising Prime Minister Keir Starmer’s “strong lobbying” efforts during their meeting yesterday.

Dollar Surges as Major Currencies Sell-off

The U.S. dollar surged on Thursday as the euro and Canadian dollar weakened, while global trade concerns triggered a sell-off in risk-sensitive currencies like the Australian dollar.

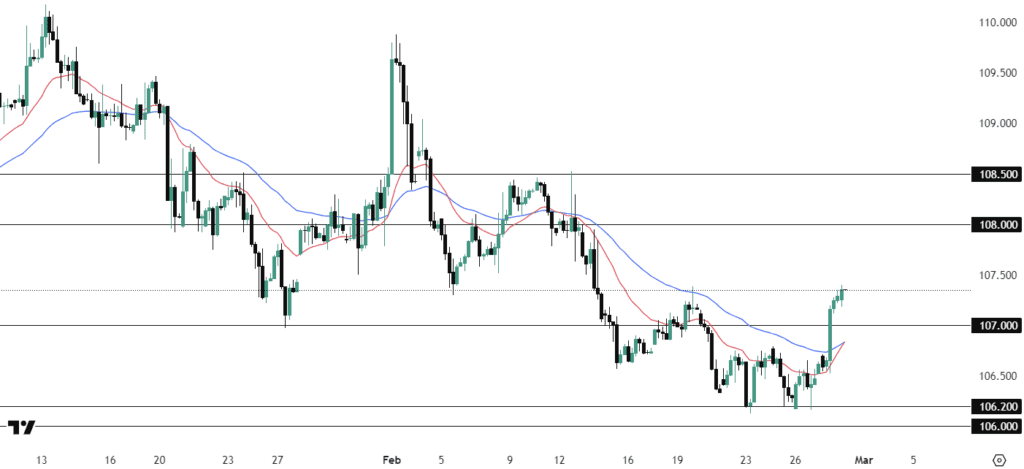

(US Dollar Index, 4H Chart Analysis; Source: Trading View)

The DXY found strong support near 106.15, forming a triple-bottom pattern earlier this week, which fuelled the dollar’s rally. Currently, the index is trading around 107.00. If this level holds, further upside momentum in the U.S. dollar remains possible, supported by prevailing market conditions.

Russian-Ukraine Peace Talks Positive

Trump also discussed on the ongoing situation in Ukraine on meeting with UK Prime Minister Starmer yesterday, and expressed confidence in Russian President Putin’s commitment to a peace deal.

Russia reiterated its key demands, including:

- Recognition of its annexation of certain Ukrainian territories.

- Ukraine’s commitment to not seeking NATO membership.

- Opposition to the deployment of NATO peacekeeping forces in Ukraine.

President Vladimir Putin acknowledged that European countries will eventually need to be involved in the peace process.

Markets are closely monitoring the upcoming high-level meeting, which is expected to include European leaders and potentially direct negotiations between U.S. President Donald Trump, Putin, and Ukrainian President Volodymyr Zelensky. These discussions could have a significant impact on geopolitical stability.

Gold Enters a Corrective Moves

Although no concrete peace deal has been reached yet, the positive developments in the Ukraine peace talks have weakened demand for safe-haven assets, leading to a pullback in gold from its record highs.

(XAU/USD, 4-H Chart Analysis; Source: Trading View)

Gold has broken below the key 2880 support level, signaling a potential continuation of its corrective move toward the next major support at 2840.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Ultima Markets에서 금속 및 원자재 거래를 하는 이유는 무엇인가요?

Ultima Markets는 전 세계적으로 널리 사용되는 원자재에 대해 가장 경쟁력 있는 비용과 거래 환경을 제공합니다.

거래 시작하기이동 중 시장 모니터링

공급과 수요의 변화에 민감한 시장

가격 투기에만 관심이 있는 투자자에게 매력적

숨겨진 수수료 없는 깊고 다양한 유동성

딜링 데스크 없음 및 재호가 없음

Equinix NY4 서버를 통한 빠른 실행