Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

Markets Bet on June Rate Cut

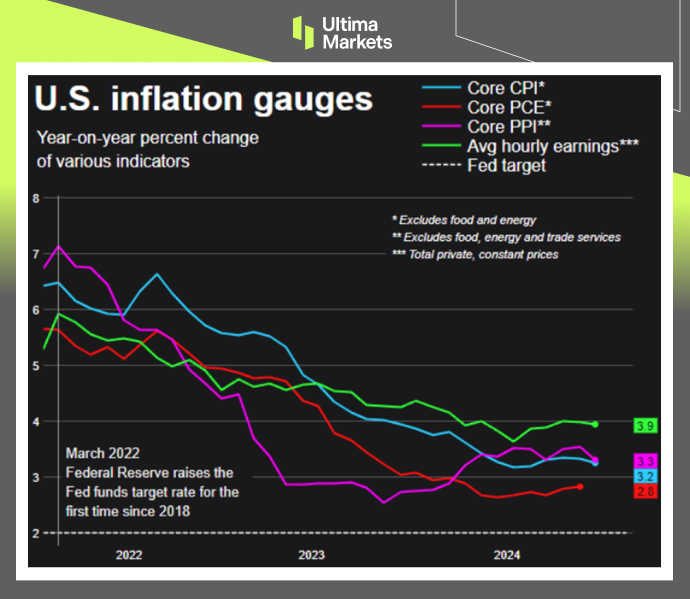

The consumer price index (CPI) climbed 0.4% last month, marking the largest increase since March, following a 0.3% rise in November, as reported by the Bureau of Labor Statistics. Annually, CPI rose 2.9% through December, the highest since July, up from November’s 2.7%.

Part of the annual CPI rise was due to the removal of lower readings from last year’s calculations. Recent progress in curbing inflation has stalled, with consumer inflation expectations spiking in January amid concerns over tariffs raising goods prices.

(U.S. Inflation Gauges, Source: LSEG DataStream)

No rate cut is expected at the Federal Reserve’s January 28-29 meeting. However, financial markets have increased bets on a rate reduction in June. Since beginning its easing cycle in September, the Fed has cut its benchmark rate by 100 basis points to 4.25%-4.50%. This shift has supported expectations of moderate inflation readings and reinforced predictions for a June rate cut.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Ultima Markets에서 금속 및 원자재 거래를 하는 이유는 무엇인가요?

Ultima Markets는 전 세계적으로 널리 사용되는 원자재에 대해 가장 경쟁력 있는 비용과 거래 환경을 제공합니다.

거래 시작하기이동 중 시장 모니터링

공급과 수요의 변화에 민감한 시장

가격 투기에만 관심이 있는 투자자에게 매력적

숨겨진 수수료 없는 깊고 다양한 유동성

딜링 데스크 없음 및 재호가 없음

Equinix NY4 서버를 통한 빠른 실행